SPILP INVESTMENTS "FACE 3"

Strategic Insights: Unlocking Value in a Transforming Market

At Paulson and Partners, we believe that successful investment are the result of foresight, meticulous planning, and disciplined execution. Dubai’s real estate market presents a compelling case study in transformation, offering a unique blend of opportunity and maturity for discerning investors.

The city’s rapid development has given rise to a multi-layered property market, each segment presenting its own set of dynamics and opportunities.

Special Purpose Investments in Luxury Properties (SPILP) remain a niche market in the UAE, driven by scarcity and the fact that owners of such properties rarely allow them to be publicly promoted.

Off-Plan Real Estate Projects

Focused on investments in developments under construction, this segment has historically attracted those seeking early entry into Dubai’s growth story. While still promising, it requires a long-term perspective and patience. Off-plan projects typically take 3-4 years to complete, with government-backed payment plans providing both security and flexibility.

Secondary Market

This established segment appeals to investors seeking stability, liquidity, and immediate asset access. Properties in this market typically offer consistent returns, though with limited potential for exceptional gains. However, the city is still evolving, and investors often pay a premium to Off-Plan sellers offering brand-new properties.

Renovations in the Luxury Segment (SPILP)

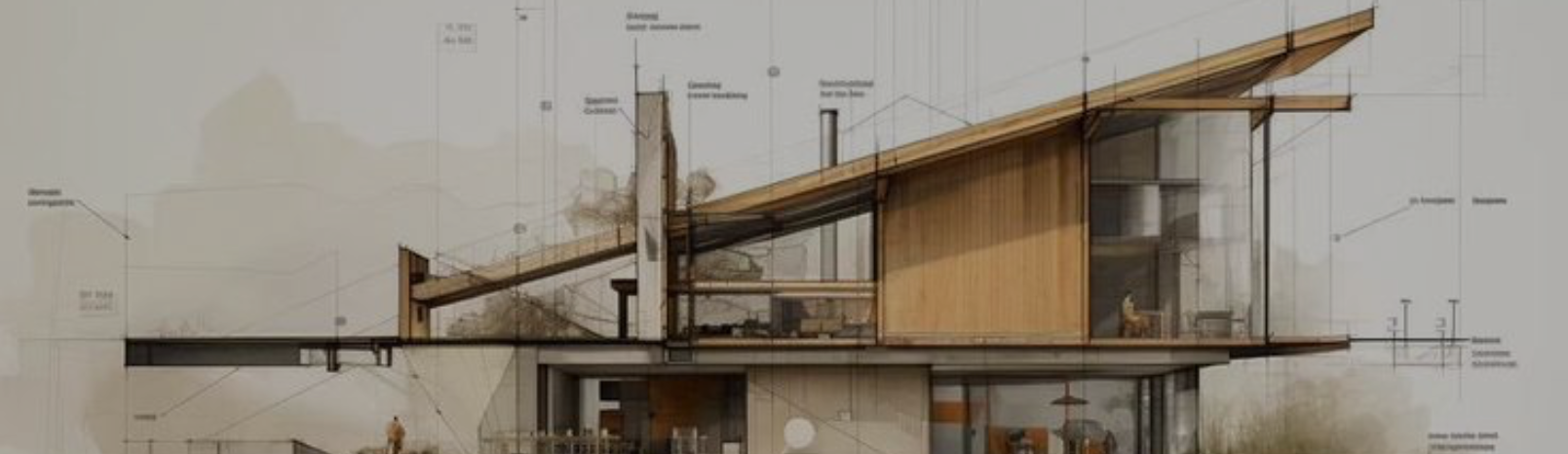

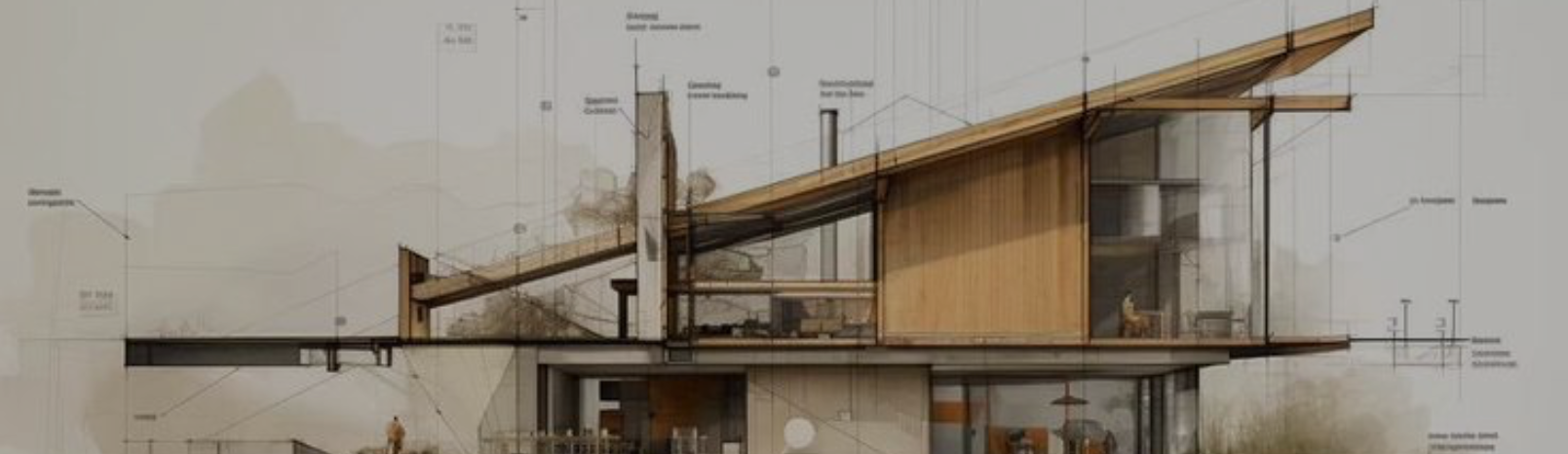

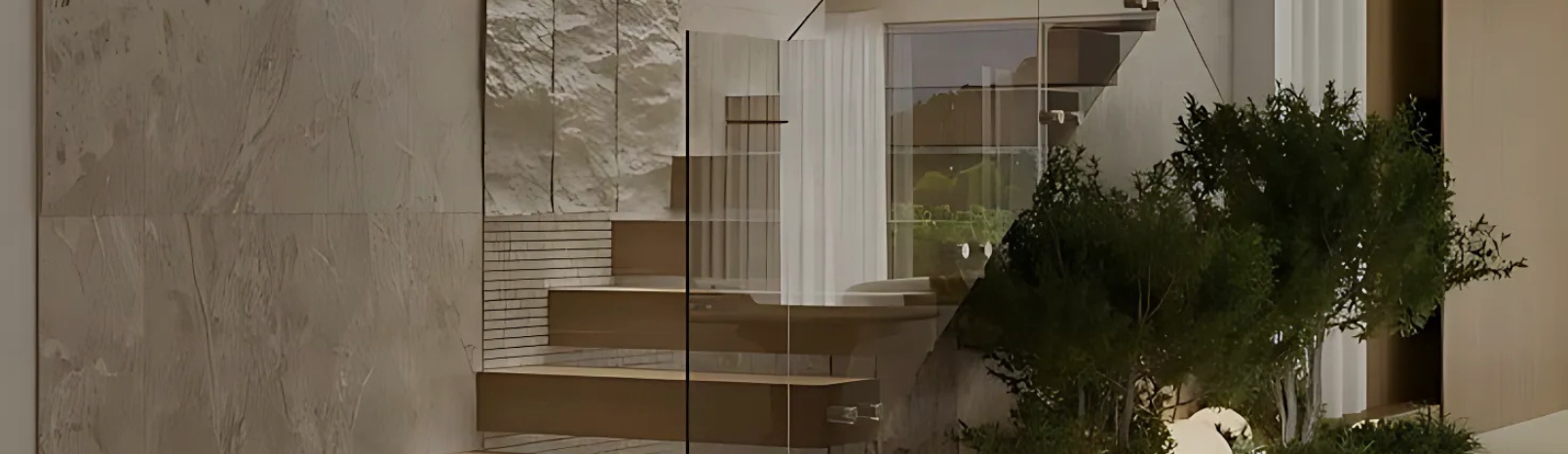

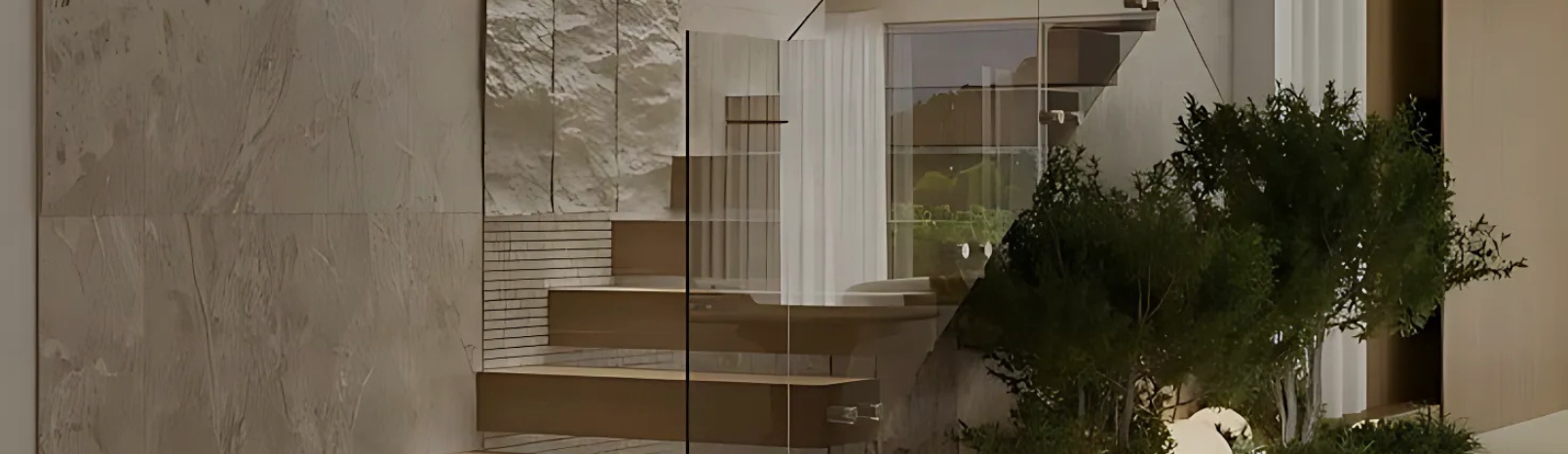

After two decades of robust development, a new and compelling investment thesis has emerged. High-value properties in Dubai’s prime locations now offer significant opportunities for strategic renovation and repositioning. This phase, which we term “Face 3,” is characterized by the ability to create meaningful value through thoughtful enhancements, leveraging market demand for ultra-luxury and bespoke properties.

Our Process

Our process begins with a thorough analysis of the client’s investment structure, including source of funds and Ultimate Beneficial Owner (UBO) details. This allows us to implement tailored tax optimization strategies, ensuring the investment is structured for maximum efficiency and profitability from the outset.

We leverage our extensive UAE network to identify off-market luxury properties in prime, scarce locations. This approach ensures access to exclusive opportunities, free from market saturation, and positioned for high-value returns.

Once acquired, we execute renovations to the highest construction standards, focusing on value creation through strategic improvements and bespoke design. Each project is managed to ensure optimal enhancement, maximizing long-term asset value.

Post-renovation, we provide tailored solutions for property disposition, either through sale at enhanced value or strategic rental management. Both options are designed to achieve the client’s financial goals.

From tax structuring to final asset disposition, our strategy ensures the highest possible return on investment. Exclusively mandate-based, our approach is reserved for the most discerning investors, ensuring unparalleled professionalism and success.

EN

EN DE

DE