Value Added Tax and Indirect Tax Consulting: Minimizing Risks, Maximizing Value

Value-added tax (VAT), known in some countries as goods and services tax (GST), is a type of tax levied on the price of a product or service at every stage of production, distribution, or sale to the end consumer. VAT was introduced in the United Arab Emirates (UAE) on January 1, 2018, with a standard rate of 5% applied to most goods and services, though some exemptions exist.

At Paulson and Partners, our team of indirect tax experts provides clients with strategic planning, analysis, and advisory services for VAT and other indirect taxes. Whether supporting national operations or international expansions, we are committed to helping businesses navigate VAT complexities efficiently and effectively.

Dual-Focus VAT Services: Risk Management and Savings Optimization

Our VAT consulting services are designed with a dual focus:

- Identifying and Mitigating Tax Risks We help businesses manage and reduce VAT-related risks, both in the UAE and internationally, by providing proactive solutions to ensure compliance and avoid potential tax liabilities.

- Maximizing Savings and Opportunities Recognizing the significant cash flow impact of VAT, we work with clients to optimize their VAT strategy. Our approach targets both absolute savings and financial gains with a high treasury impact, uncovering opportunities for tax savings and efficiencies that support growth.

Mastering Cross-Border Challenges with Future-Ready Trade and Customs Expertise

In today’s global landscape, cross-border transactions and supply chain structuring present organizations with the challenge of navigating complex regulations and rising protectionism. Paulson and Partners offers deep commercial and technical expertise to help clients achieve their business objectives by providing innovative and practical solutions tailored to international trade and customs compliance.

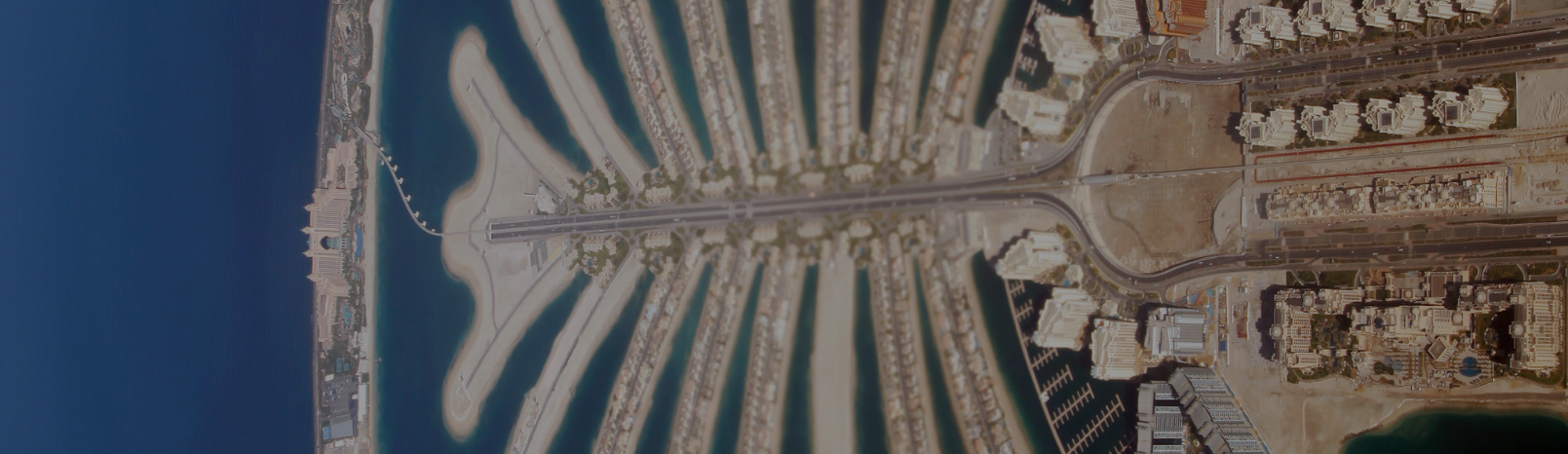

The Middle East: A Strategic Global Trade Hub

The Middle East has long been a key trading corridor between East and West, drawing global businesses with its high-quality infrastructure and versatile supply chain solutions. Organizations in the region benefit from an expansive network of Free Trade Agreements and localized relief programs, enhancing supply chain security and ensuring efficient market access.

By leveraging these advantages, businesses can strengthen their proximity to key markets, streamline trade facilitation, and enhance operational resilience. The Middle East’s strategic position and infrastructure make it an ideal hub for global trade expansion.

Adapting to a Fast-Evolving Trade Landscape

As Middle Eastern countries modernize their market access infrastructure and diversify their economies, businesses face an increasingly complex regulatory environment. At Paulson and Partners, we simplify the local customs regulatory framework, ensuring compliance while keeping clients competitive in a rapidly changing market. Our extensive network and local expertise enable us to anticipate challenges and provide seamless access to Middle Eastern markets through proactive, strategic guidance.

Doing Business in the UAE

The Strategic Hub for Global Business and Trade

The United Arab Emirates (UAE) serves as a strategic gateway linking Europe, Africa, and Asia. Known for its business-friendly policies, the UAE offers an ideal base for companies looking to establish regional headquarters, conduct international trade, or benefit from favorable tax regimes. With proximity to a consumer base exceeding 2 billion, the UAE presents unparalleled access to high-growth markets.

Why Choose the UAE for Your Business?

The UAE offers a highly attractive business environment, with continuous new opportunities supported by investor-friendly legislation, a robust financial system, and advanced infrastructure. These attributes make the UAE an ideal location for various business needs:

- Establishing holding, trading, financing, or support platforms for a group’s international operations

- Creating a regional hub to manage and grow business across the Middle East, Africa, and Asia

- Expanding local business within the UAE’s dynamic market

A Pro-Business Environment with Long-Term Initiatives

With a focus on fostering growth, the UAE government has introduced numerous initiatives aimed at strengthening the business environment and driving development across the Emirates. This commitment to progress, coupled with the availability of skilled resources and an infrastructure built for success, positions the UAE as a strategic hub for both regional and global operations.

This guide provides foundational information on doing business in the UAE from an inbound investor’s perspective. For the latest insights and updates, please visit our website.

Recent Highlights: Key Developments in UAE’s Business Environment

National Agenda for Entrepreneurship and SMEs

The National Agenda for Entrepreneurship and SMEs seeks to position the UAE as a global entrepreneurial leader by 2031. This ambitious Agenda spans seven key themes that shape its activities: Ease of Doing Business, Innovation, Business Support, Digital Transformation, Funding, Human Capital & Increasing Demand

Corporate Tax Legislation

The UAE Ministry of Finance introduced Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses. This law provides the legislative foundation for Federal Corporate Tax, effective for tax periods starting on or after 1st June 2023. The law marks a significant shift toward structured corporate tax regulation, aligning the UAE with global tax standards while supporting transparency and compliance.

Immigration Updates: Golden Visa, Green Visa, and More

The New Immigration Regulations (Federal Decree No. 29 of 2021, Cabinet Decisions No. 8 of 2021 and No. 65 of 2022) introduce enhanced residency options, including:

Golden Visa For individuals who contribute significantly to the UAE’s economy, innovation, and knowledge sectors.

Green Visa For skilled workers, freelancers, and investors who wish to live and work in the UAE independently.

Residency permits now fall into two categories based on the purpose of stay, streamlining immigration processes and providing more opportunities for long-term residence.

Labor Law Revisions and Emiratization Initiatives

Under the New Labor Law (Federal Law Number 33 of 2021 and Cabinet Resolution No. 1 of 2022), recent changes include:

Increased Emiratization Quotas From January 1, 2023, Emiratization quotas have been raised with a goal of reaching a 10% increase by 2026. Note that these quotas do not apply to Free Zone Companies.

Mandatory Unemployment Insurance As of January 1, 2023, the UAE implemented an unemployment insurance scheme aimed at providing income security for employees.

Doing Business in the UAE

National Agenda for Entrepreneurship and SMEs (2031) Designed to position the UAE as a global leader in entrepreneurship by 2031, the Agenda focuses on themes such as ease of doing business, digital transformation, business support, and innovation.

Corporate Tax Introduction (2023) Effective from June 2023, Federal Decree-Law No. 47 of 2022 implements a corporate tax regime. It standardizes UAE business tax structures and fosters compliance while offering flexibility for Free Zone entities with 0% tax benefits, when meeting specific conditions.

Enhanced Residency and Immigration Options The Golden Visa and Green Visa initiatives provide residency options for investors, skilled professionals, and freelancers, adding flexibility and support for talent acquisition and retention.

Labor Law Enhancements The UAE’s New Labor Law (Federal Law Number 33 of 2021) emphasizes workforce inclusivity and stability. Key features include:

- Emiratization Quotas:- Targeted to increase Emirati workforce participation by 10% by 2026.

- Unemployment Insurance:- A mandatory scheme introduced in January 2023, enhacing job security.

Geographic and Trade Advantage Serving as a nexus between East and West, the UAE’s extensive Free Trade Agreements (FTAs) and state-of-the-art infrastructure offer global businesses robust logistical support and simplified trade processes.

Investor-Friendly Policies With over 50 Free Trade Zones (FTZs), businesses benefit from 100% foreign ownership, tax exemptions, and streamlined registration processes in specialized zones like the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM).

World-Class Infrastructure The UAE boasts globally recognized seaports and airports that enhance supply chain efficiency and market accessibility.

Technology and Digital Transformation The UAE’s rapid adoption of AI, IoT, and blockchain technology provides abundant opportunities for innovation. Government initiatives support businesses engaged in technology-driven sectors and contribute to building a digital economy.

Financial Services and Tax Advisory The UAE’s corporate tax law provides a structured yet competitive environment for financial services firms. Paulson and Partners assists clients with tax structuring, transfer pricing, and compliance to ensure sustainable operations.

Healthcare and Life Sciences Driven by demographic growth and government investments, the UAE healthcare sector continues to expand, offering opportunities in biotech, medical technology, and personalized care solutions.

Renewable Energy and Sustainability Aligned with global sustainability goals, the UAE is heavily investing in renewable energy projects. Paulson and Partners help firms align with ESG frameworks, navigate regulatory environments, and build sustainable growth strategies.

Mainland Entities Mainland entities in the UAE benefit from direct access to the local market. Options include:

- Branches:Operate as an extension of the parent company.

- LLCs (Limited Liability Companies):Allow direct business activities across the UAE.

Free Trade Zone Entities FTZs offer tax incentives and 100% foreign ownership.Common structures include:

- Free Zone Establishments (FZE):A single-shareholder entity.

- Free Zone Company (FZCO):A multi-shareholder company.

Offshore Entities For businesses operating solely outside the UAE, offshore entities provide tax efficiency with minimal setup requirements.

Standard Corporate Tax Rates: 0% for qualifying Free Zone income and 9% for taxable income above AED 375,000.

Transfer Pricing Compliance UAE’s regulations align with OECD principles to ensure fairness in related-party transactions.

Economic Substance Regulations (ESR) Required for businesses in sectors like banking, insurance, and shipping to substantiate UAE-based economic activities.

Value-Added Tax (VAT) Introduced in 2018, VAT applies at a standard rate of 5% on goods and services, with exemptions available. Businesses must register if their annual taxable turnover exceeds AED 375,000.

Customs and Excise Tax As part of the GCC Customs Union, UAE imports incur a standard duty rate of 5%. Excise tax on items such as tobacco and energy drinks applies at rates up to 100%, promoting healthier consumption patterns.

The UAE’s strategic initiatives, coupled with its investor-friendly landscape, make it a robust platform for global businesses. At Paulson and Partners, we provide clients with customized advisory services to navigate UAE regulations, optimize tax strategies, and leverage the UAE’s dynamic market for growth.

Global Indirect Tax Services: Strategic Solutions

for a Complex World

Our Global Indirect Tax Services are designed to address the diverse needs of organizations operating across borders, ensuring effective tax management and compliance. Here’s how we support our clients:

Technology-Enabled Indirect Tax Strategies We advise businesses on the development and execution of technology-driven indirect tax management strategies, covering internal governance, processes, and cross-jurisdictional compliance. Our approach integrates digital solutions to streamline tax functions and maximize efficiency.

Comprehensive Tax Compliance Services Our practical tax compliance services help tax leaders manage risk, improve efficiency, and unlock data value. Support includes VAT/GST compliance outsourcing, global VAT/GST recovery, reverse audit services, and more, enabling clients to stay compliant and optimize their tax position.

Market Entry and Transaction Support For organizations entering new markets or undergoing corporate restructuring, mergers, or acquisitions, we provide critical indirect tax guidance to ensure smooth transitions and minimize tax liabilities.

Indirect Tax Audit and Investigation Support We assist businesses facing indirect tax audits or investigations from tax or customs authorities, providing robust defense strategies and minimizing potential disruptions to business operations.

Legal Advisory for Indirect Tax Our experts offer legal advisory on indirect tax matters, including contract review, dispute resolution, and litigation support, helping clients navigate complex tax issues with confidence.

Paulson and Partners is committed to helping clients navigate the evolving global indirect tax landscape. With our strategic insights and technology-enabled solutions, we empower businesses to achieve compliance, optimize tax strategy, and enhance efficiency across international markets.

EN

EN DE

DE